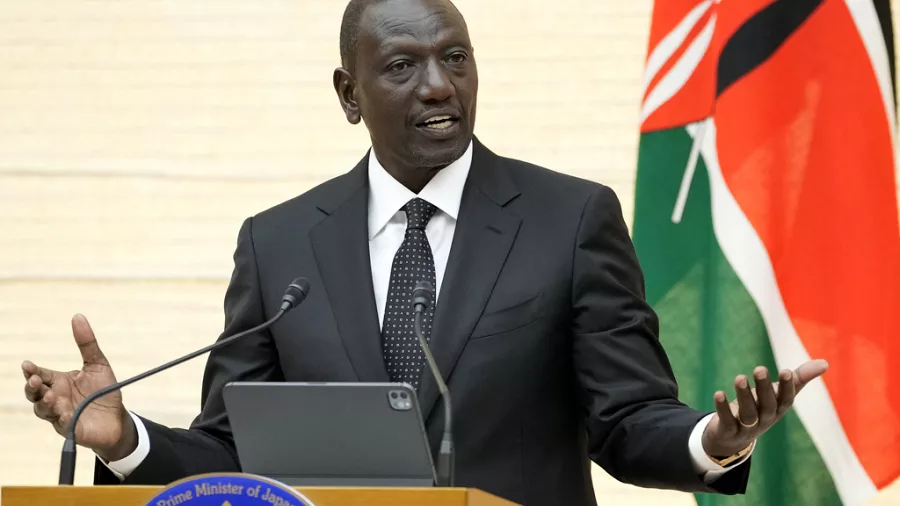

President William Ruto has hailed the government’s success in promoting financial inclusion through the Financial Inclusion Fund, popularly known as the Hustler Fund, which he says has transformed access to credit for millions of Kenyans.

Speaking on Tuesday, Ruto said the fund has disbursed over Sh80 billion since its launch in November 2022, directly benefiting individuals and small businesses previously excluded from formal lending systems.

He explained that one of the main objectives of the Hustler Fund was to support micro and small enterprises that had been blacklisted by credit reference bureaus (CRBs) and were unable to access loans.

“In 2022, about 7 million Kenyans, including 3 million micro enterprises, were listed at the credit reference bureaus and could not operate. We intervened to restore their access to financial services,” Ruto said.

According to the President, the government negotiated with CRBs to redeem the credit status of 7 million Kenyans, giving them a second chance to do business. Currently, over 2 million Kenyans borrow regularly from the Hustler Fund, while close to 800,000 small businesses benefit through its bridge finance product.

Ruto noted that the fund allows citizens to access up to Sh150,000 without traditional collateral such as payslips, title deeds, or logbooks—relying instead on their repayment records.

He also outlined broader economic initiatives tied to the Hustler Fund’s goals, including the establishment of county aggregation and industrial parks in all 47 counties to promote agro-processing and strengthen value chains.

Additionally, Ruto highlighted the development of special economic zones in Naivasha, Busia-Nasewa, Eldoret, Kirinyaga, and Dongo Kundu, as well as the government’s plan to expand digital infrastructure through a 100,000km digital superhighway—with 30,000km already completed.

These initiatives, he said, will enhance trade, attract investment, and empower the Jua Kali sector by linking affordable credit with industrial and digital growth.