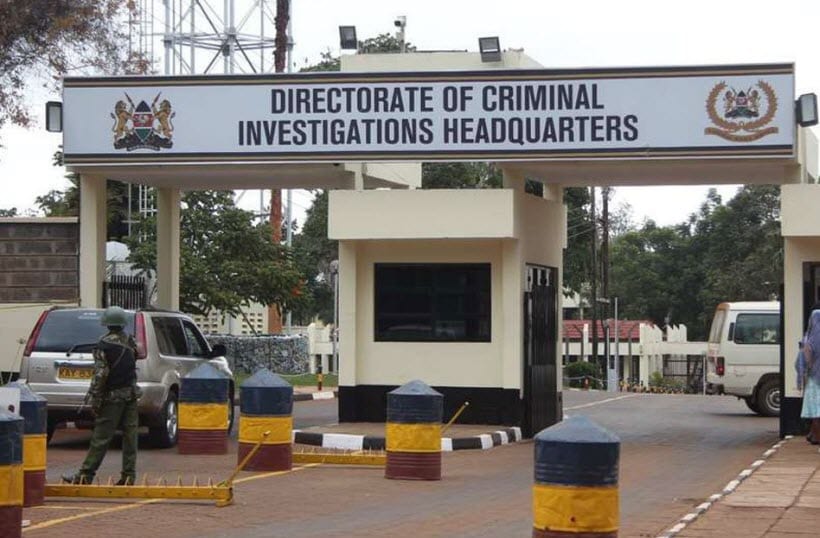

Detectives from the Directorate of Criminal Investigations (DCI) have arrested a 26-year-old university dropout accused of hacking into a betting company’s systems and stealing Ksh11.4 million. The suspect, a former second-year Bachelor of IT student at the University of Meru, was apprehended on Saturday, August 30, at his two-bedroom apartment in Tatu City.

According to the Central Region Investigations Officer, Abraham Mugambi, the suspect had executed several similar cybercrimes targeting well-known brands. Mugambi revealed that investigations began in July after the betting firm reported losing millions through fraudulent transactions.

“This year in July, a report was made that a payment service provider had lost Ksh11.4 million through fraudulent means. Investigations commenced, and our teams of experts established that the fraud was committed after the individual bypassed the security systems of the company,” Mugambi stated.

During the raid, detectives recovered multiple laptops, desktop computers, a money-counting machine, a safe, and other electronic gadgets believed to have been used in the crimes.

In his defense, the suspect claimed he was a cybersecurity engineer, insisting that his actions were part of an “independent consultancy” rather than theft. He reportedly told officers, “This is what I do.”

The DCI has vowed to intensify the fight against cybercrime, which has increasingly targeted financial institutions and digital platforms. “We are grappling with white-collar crime, particularly computer crimes, and what I want to assure the public is that the National Police Service is up to the task. Criminals may run, but they cannot hide from us,” Mugambi affirmed.

This latest arrest comes just four months after the DCI nabbed five suspects accused of hacking into bank accounts and siphoning more than Ksh3.2 million. That operation stemmed from a mobile phone theft incident in Nairobi, which eventually exposed a wider hacking scheme.

The DCI has since urged companies and financial institutions to strengthen their digital security systems to curb rising cyber fraud cases.