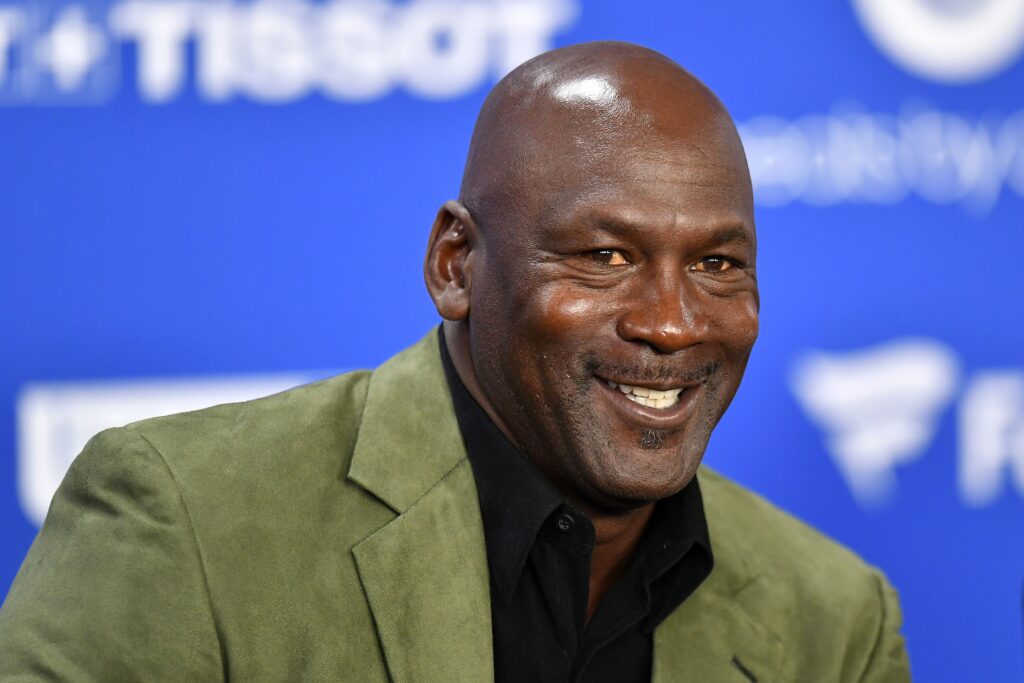

Michael Jordan’s long-marketed Highland Park estate has finally found a buyer at a steep markdown that shows how even blue‑chip celebrity properties can linger when pricing overshoots reality. Jordan first listed the seven‑acre Illinois compound in 2012 for $29 million. After more than a decade of price cuts, creative marketing gambits, and renewed brokerage pushes including a memorable $14.855 million ask nodding to his iconic No. 23 the property has now sold for about $9.5 million, less than a third of the original price. That caps roughly 13 years of waiting.

The protracted sales saga became a real‑estate case study. Ultra‑custom luxury builds appeal to a razor‑thin buyer pool; add in Chicago‑area property taxes, significant operating costs for resort‑style amenities, and the psychological hurdle of purchasing a home so closely branded to one global superstar, and the challenge magnifies. Over time, agents refreshed marketing, tested alternative strategies, and leaned on the estate’s trophy status, yet the home stayed famous mostly for not selling.

What does the buyer get? A private, gated showpiece where Jordan’s imprint is everywhere beginning with the towering “23” on the entrance gates. Inside the spread: a full‑size NBA‑grade basketball court stamped with the Jumpman logo, an infinity pool, tennis court, putting green, cigar room, and private cinema amenities built for entertaining at scale. The landscaped grounds provide seclusion while keeping access to Chicago’s North Shore culture, schools, and business corridors.

For Jordan, whose post‑playing portfolio spans ownership stakes, major brand partnerships, and a broad business empire, the closing feels less about recouping a record number and more about turning the page on a long‑running chapter of his personal real‑estate story. For market watchers, the takeaway is clear: disciplined pricing, broad‑appeal staging, and patience matter even when the seller is the greatest of all time.

Lessons for sellers of highly personalized estates: lead with lifestyle narratives that transcend the original owner, neutralize heavy personalization where feasible, and benchmark against liquid comps rather than celebrity aura. For buyers, homes that sit for years can offer negotiation leverage especially when carrying costs keep ticking.

Jordan’s Highland Park outcome will be dissected in luxury brokerage circles because it pairs an unassailable sports legacy with one of the sharpest list‑to‑sale gaps in recent memory roughly a $20 million delta from first ask to closing. Seen another way, the sale is a late‑career Jordan move: relentless, adaptive, and ultimately decisive at the rim. Real estate, like sport, rewards smart adjustments.