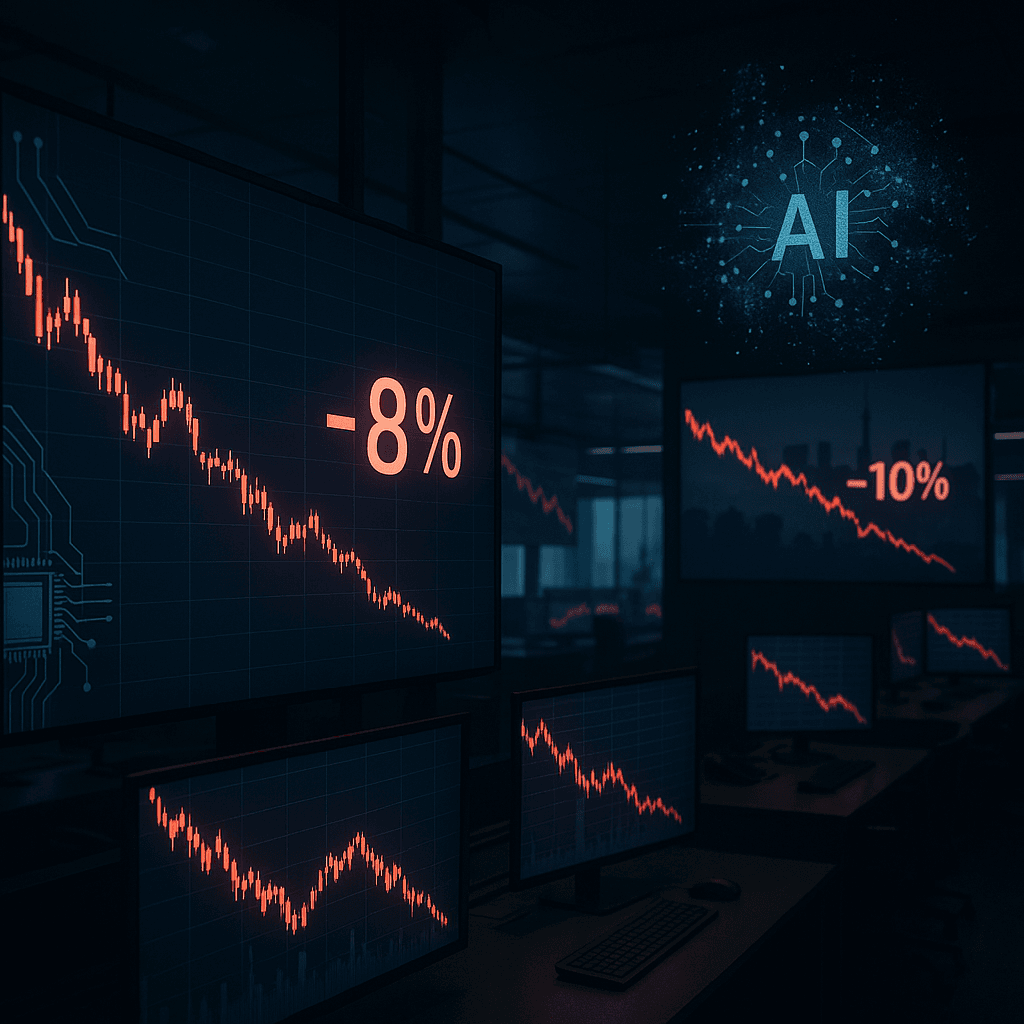

Global technology and AI stocks experienced a significant pull-back in early November 2025, with investors expressing caution over potentially inflated valuations in the rapidly growing artificial intelligence sector. The sell-off impacted major tech companies across the United States, Europe, and Asia, signaling increased market vigilance.

Investor Reassessment Drives Market Correction

Analysts suggest that the recent surge in AI-related stocks may have exceeded underlying business fundamentals, leading investors to reassess risks and reduce exposure. Companies at the forefront of AI innovation—including cloud computing providers, semiconductor firms, and AI platform developers—saw notable declines in their share prices.

Factors Behind the Decline

While AI remains a transformative technology, market speculation has created valuation pressures. Key contributing factors to the downturn include concerns over regulatory scrutiny, heightened competition, and uncertainty regarding the pace of commercial adoption of AI solutions.

“This is a classic correction driven by a mix of hype and profit-taking,” noted a market strategist. “Investors are recalibrating expectations and distinguishing between sustainable growth and short-term excitement.”

Long-Term Outlook Remains Positive

Despite the short-term correction, many analysts remain optimistic about AI’s long-term potential. Trends in automation, machine learning, and data analytics continue to support sustained growth, even as investors adjust to the sector’s volatility. The recent pull-back serves as a reminder of the inherent risks in markets driven by emerging technologies.