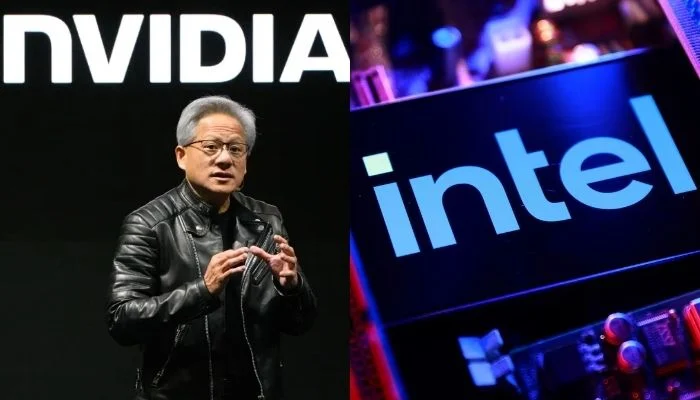

In a surprising turn for the semiconductor industry, Nvidia has invested $5 billion into Intel, acquiring roughly a 4% equity stake after Intel issued new shares. The deal makes Nvidia one of Intel’s largest shareholders and underscores a significant strategic collaboration between two rivals turned partners.

Joint Development of High-Performance Chips

The partnership will focus on jointly developing chips for both PC and data-center markets. The goal: to merge Intel’s CPU expertise with Nvidia’s leadership in GPUs and AI accelerators, driving the next wave of high-performance computing solutions. The move comes as demand for AI hardware and cloud computing infrastructure surges globally.

Intel’s Foundry Role Clarified

While Intel’s foundry services are part of the partnership, they will not involve direct GPU manufacturing for Nvidia. Instead, Intel will provide central processors and advanced packaging technologies—a critical part of modern chip assembly as the industry stretches Moore’s Law. Nvidia will continue to rely primarily on TSMC in Taiwan for the bulk of its chip manufacturing, but Intel’s packaging capabilities add strategic flexibility.

Strategic Industry Implications

The collaboration arrives at a moment of supply chain uncertainty, U.S.-China trade frictions, and escalating demand for AI-driven semiconductors. For Nvidia, the tie-up enhances access to cutting-edge CPU and packaging expertise. For Intel, the partnership provides both a $5B capital injection and a boost to its credibility as it fights to reestablish itself as a global chipmaking powerhouse.

A New Chapter in a Historic Rivalry

Intel and Nvidia have long been fierce competitors in the PC and data center markets. But the shifting landscape—defined by AI, cloud services, and integrated computing demands—has turned old rivalries into opportunities for collaboration. While this partnership stops short of Intel manufacturing Nvidia’s GPUs, it signals a pragmatic realignment between two giants seeking to adapt and thrive in a rapidly evolving industry.